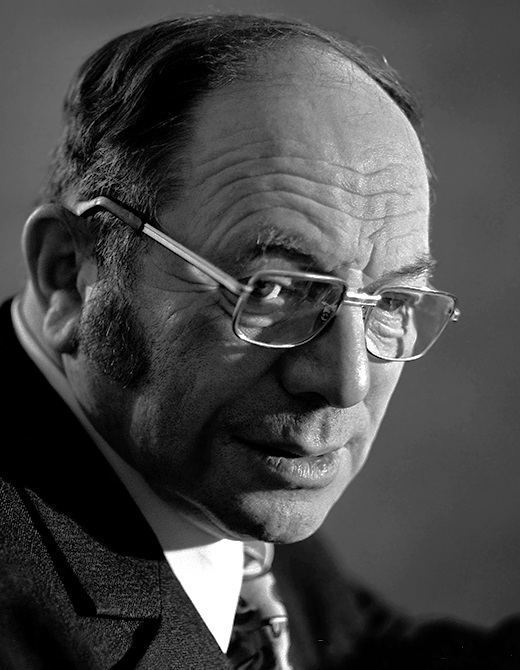

Adam Smith

Adam Smith imagined two firms with a choice of production of two products*. The two firms' entrepreneurs are Alice and Bob. Alice and Bob have the choice of producing two independent goods - maybe apples and blackboards. The firms have what has become known as "constant technology", the ratio of their outputs and their inputs is a constant independent of said quantities (different for each firm and product to avoid indeterminacy). Unemployment is ignored in both inputs and outputs - all inputs are bought and all output sold (Say's Law). The law of one price holds.

Each entrepreneur is then left with only one decision: how much of each good shall I make?

Leonid Kantorovich

The fastest way to this answer is through the theory of linear programming. Start by denoting \( L_{firm,product}\) the amount of labor Alice or Bob uses to make apples or blackboards. If \(L \) is the amount of labor available in society, then we have as a constraint

\[ L_{Alice,apples} + L_{Bob,apples} + L_{Alice,blackboards} + L_{Bob,blackboards} = L \]

The outputs are denoted \( Y_{firm,product} \) and the prices are \(p_{product}\) so that the total output is

\(Y = p_{apples} (Y_{Alice,apples}+Y_{Bob,apples})+p_{blackboards} (Y_{Alice,blackboards}+Y_{Bob,blackboards}) \).

Finally, the technical coefficients are \( a_{firm,product} = Y_{firm,product} / L_{firm,product} \) . Our goal then is to maximize the above equation We know from LP theory* that only the vertices matter. Why? Well, the short answer is interior point optimization. Look at this picture:

The dark lines are the constraints and the darkened point is a guess at the optimum. The line through that point has a slope equal to the price ratio. It's obvious that more output by moving to a guess in the direction of the arrows that is still feasible. The triangle made by the price ratio and the constraints (and its interior) are the "interior points". If an interior point set is one point, it must be the optimum. It's obvious that unless the price ratio is exactly the same slope as one of the boundaries, the only way to squeeze the interior point set down to one point is to chose one of the verticies.

Okay, so let's cycle through those verticies. The solution where no labor is used is the global minimum (the entire feasible set is the interior point set!). This also doesn't match the full employment constraint, so toss it.

Next, there's the where only one firm is buying labor to produce output (so that three \( L_{i,j}=0\) and one \( L_{i,j}=L\). We'll call this the \(Y_{one}\) solution as in "Why one?". Mathematically, it is written

\[ Y_{one} = max_{i,j}(p_j a_{i,j}L) \]

The next class of solutions is the instructive one. In these vertices, the non-negativity constraint is active on two possibilities - that is to say: labor is being hired for two reasons. But there's a problem. If both entrepreneurs are making apples, then \(Y = p_{apples} (a_{Alice,apples} L_{Alice,apples} + a_{Bob,apples}L_{Bob,apples}) \). But if Alice is more efficient, then this can't be a maximum, because moving some labor from Bob's firm to Alice would increase output. This knocks out the two competitive verticies and leaves the four non-competitive verticies. Either one firm allocates labor two both products (and the other is dead) or two firms specialize in one product.

Read the above paragraph again, slowly. It's important to understand the next part. If you look at the verticies with three or all four labor hiring reasons, then the accounting for \( Y \) always has at least one term like the above. For instance, one of the three term verticies is \(Y = p_{apples} (a_{Alice,apples} L_{Alice,apples} + a_{Bob,apples}L_{Bob,apples}) + p_{blackboards}L_{Bob,blackboards} \) . But this can't be a maximum, because of the above paragraph - if Alice is more efficient in apple growing we can get more output by moving some labor from Bob's firm to hers.

There are therefore only possible three classes of extreme verticies: Alice or Bob make one thing, Alice or Bob make everything and finally Alice and Bob specialize.

David Ricardo

Phew! The great economist David Ricardo was uncomfortable with Smith's story. The vertices where one firm did everything and the other was non-existent troubled him.

Why would a non-existent firm trouble someone? Well, Ricardo was exploring an analogy between firms and nations. Nations have different technical coefficients - nobody needs to explain why California produces more wine than Utah or why Kazakhstan produces more uranium than Italy. But the idea that a country could "dominate" and produce everything was very troubling - not to mention that it seemed contrary to the facts.There was a political economy problem as well. Absolute advantage seems to suggest that global and local output could be at cross terms - global output might be maximized at the minimum of local output.

Ricardo "solved" this problem by ... restricting free trade! Yes, the classic argument for free trade assumes trade restrictions. Ricardo supposed that labor and capital couldn't move over national borders, but that consumption goods can.

John von Neumann

In the language of Linear Programming, Ricardo breaks the one labor constraint in the above problem into two:

\[ L_{Alice,apples} + L_{Bob,apples} =L_{Alice} \]

\[ L_{Bob,apples} +L_{Bob,blackboards} = L_{Bob}\]

Now the one firm produces everything equilbria are knocked out - they don't satisfy the above constraints. How they will specialize depends on the price ratio and technical coefficients, but they must always produce.

Comparative advantage is often thought of as a "long run" view - this is the supposed justification for the assumption of full employment and full consumption. But if capital and labor can flow over borders, it is a short run view that ignores unemployment and underconsumption.

Or is there a better interpretation of how comparative advantage works?

* The Adam Smith of my imagination.